sacramento tax rate calculator

The December 2020 total local sales tax rate was also 8750. Please visit our State of Emergency Tax Relief page for additional information.

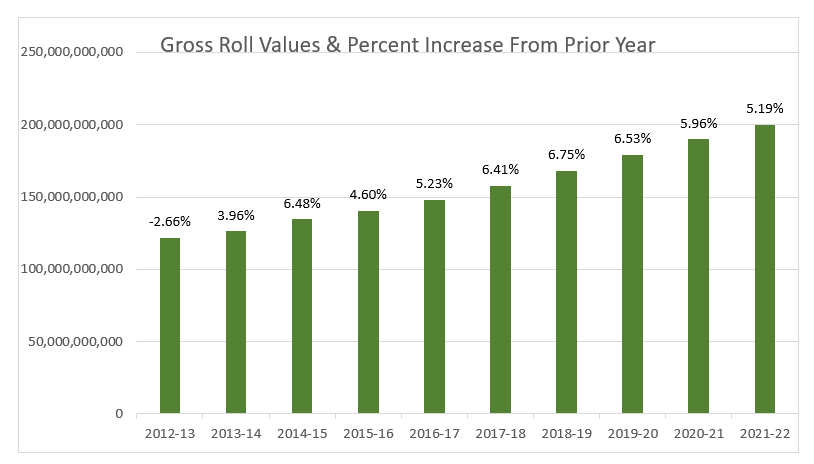

2021 22 Sacramento County Property Assessment Roll Tops 199 Billion

The december 2020 total local sales tax rate was also.

. Sacramento County Sales Tax Rates for 2022. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The minimum combined 2022 sales tax rate for Sacramento California is.

This is the total of state county and city sales tax rates. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. This rate is made up of 600 state sales tax rate and an additional 125 local rate.

View the E-Prop-Tax page for more information. What is the sales tax rate in Sacramento California. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

As we all know there are different sales tax rates from state to city to your area and everything combined is the. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. You can find more.

Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 819 in Sacramento County. West Sacramento in California has a tax rate of 8 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in West Sacramento totaling 05.

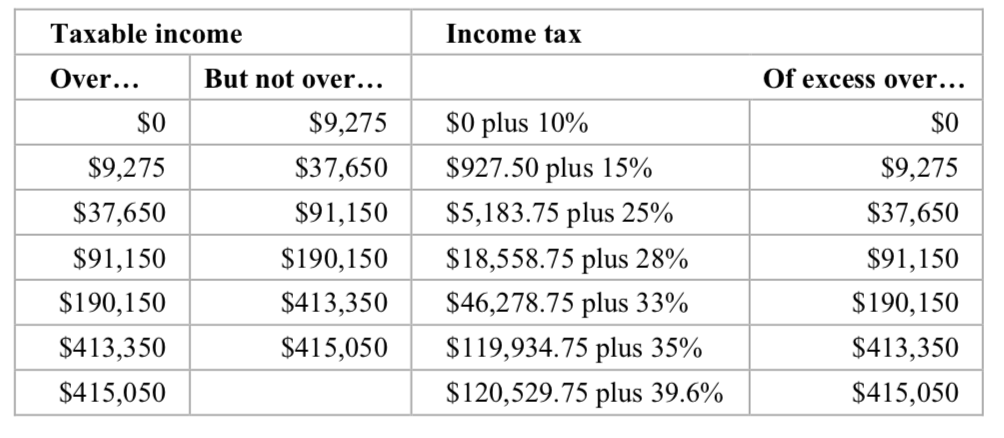

The total sales tax rate in any given location can be broken down into state county city and special district rates. The median property tax on a 32420000 house is 340410 in the United States. Your employer withholds a 62 Social Security tax and a.

Sales Tax Table For Sacramento County California. The property tax rate in the county is 078. After searching and selecting a parcel.

Sales Tax Calculator Sacramento. Sacramento County collects on average 068 of a propertys. View the Boats and Aircraft web pages for more information.

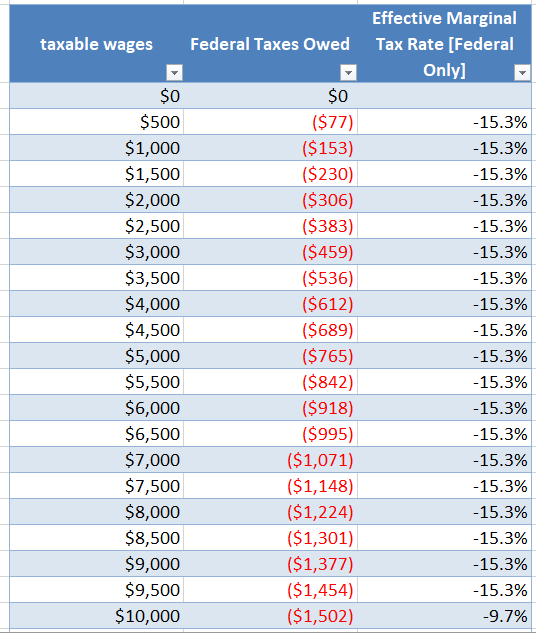

Method to calculate Sacramento County sales tax in 2021. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction.

Sacramento in California has a tax rate of 825. The current total local sales tax rate in Sacramento CA is 8750. Our Sacramento County Property Tax Calculator can estimate your property taxes based on similar properties.

The combined tax rate of 875 consists of the california sales. Privately and commercially-owned boats and aircraft are also subject to personal property taxes. A breakdown of the City of Sacramento sales tax rate.

Our property tax data is based on a 5-year study of median.

Benefit Calculator Sacramento County Employees Retirement System

4 Ways To Calculate Sales Tax Wikihow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Understanding California S Property Taxes

Is A Flat Tax Rate Right For America How Money Walks How 2 Trillion Moved Between The States A Book By Travis H Brown

Casio Sl 300vc Pk 8 Digit Calculator Protective Wallet Case Dual Power Pink Walmart Com

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Tax Breaks For Small Farms And Agribusiness In California

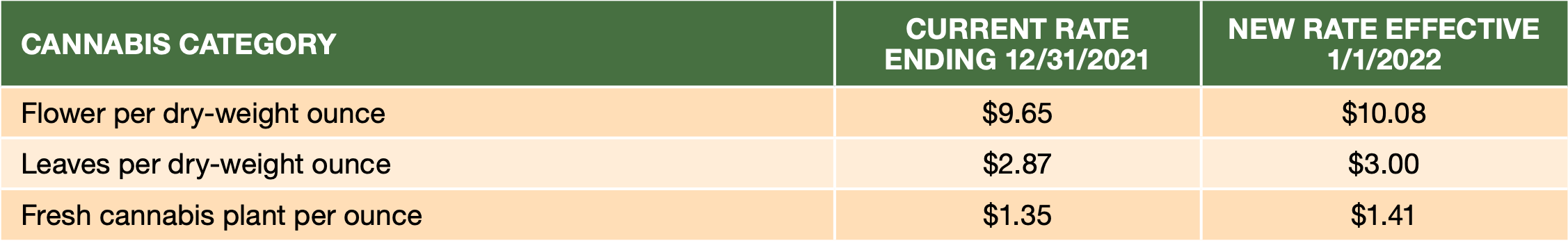

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

How Accurate Are Online Tax Calculators Incompass Tax Estate And Business Solutions Sacramento

Rental Property Returns And Income Tax Calculator

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

California Taxes A Guide To The California State Tax Rates

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

2021 Tax Calculator Frugal Professor

Rate Calculator Old Republic Title

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier